A government-approved retirement savings scheme that helps you build a corpus for your post-retirement financial security.

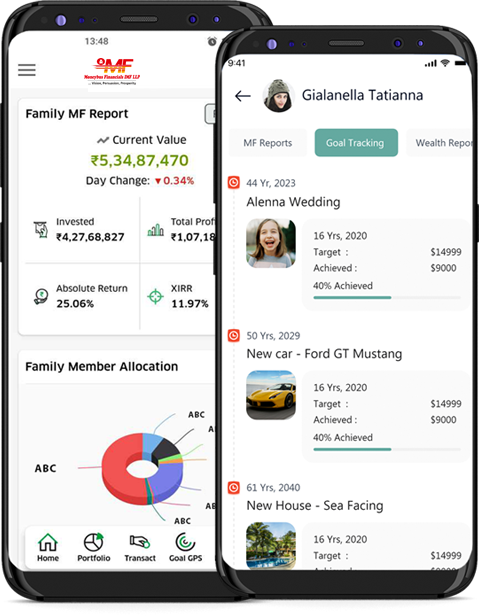

Investment vehicles that pool money from various investors to invest in a diversified portfolio of stocks, bonds, etc.

P2P lending enables individuals & businesses to borrow or lend money directly without involving traditional financial institutions.

You can use your mutual fund investments as collateral to secure a loan, offering liquidity without selling your investments.

A comprehensive strategy to manage and achieve financial goals, which includes budgeting, investing, and retirement planning.

A policy that covers medical expenses, ensuring financial protection and access to quality healthcare services.

A contract providing financial security to beneficiaries in case of the policyholder's demise, safeguarding their future.

Owning a part of a company, which can grow in value and potentially pay you a share of its profits.

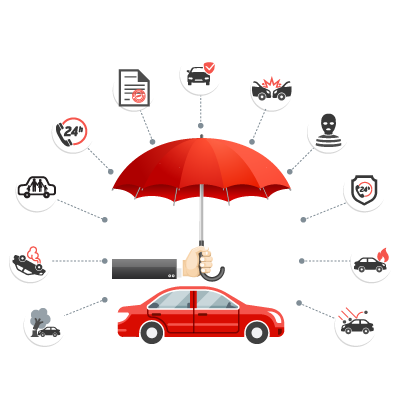

Policies that protect against non-life risks, including home, auto, and travel insurance, offering financial security in unforeseen situations.

Debt securities that pay periodic interest and return the principal amount upon maturity, providing a stable source of income.

Professional management of investment portfolios, ensuring optimal growth strategies tailored to individual risk tolerance and goals.

Secure investments with fixed interest rates, ideal for risk-averse investors looking for steady returns.

A traditional investment choice, offering a store of value and a hedge against inflation and economic uncertainties.

Ownership in a company, with the potential for capital appreciation and dividends, but also associated with market risks.

Portfolio Login

Portfolio Login Mutual Fund Research

Mutual Fund Research  Mutual Funds

Mutual Funds P2P Lending

P2P Lending Loan Against Mutual Fund

Loan Against Mutual Fund Financial Planning

Financial Planning Health Insurance

Health Insurance Life Insurance

Life Insurance Equity & Tax Saving

Equity & Tax Saving

.jpeg)

.jpeg)